In Israel Crisis Often Creates Opportunity - 5/16/23

The Israeli stock market is in a rough patch. Last year the Tel-Aviv 125 Index declined 10.7% in shekels but fell 22.0% when translated into dollars. The Bluestar Israel Global Index, which includes Israeli technology companies listed in the United States and is quoted in dollars, tumbled 25.1% last year. After weakening 11.9% relative to the dollar in 2022, the shekel declined another 4% so far in 2023.

Like other global financial markets, the aggressive shift in interest rate policy by the U.S. Federal Reserve from 0% at the beginning of 2022 to a Fed Funds rate of 5% today placed downward pressure on Israeli stocks. The shekel also weakened as Bank of Israel interest rate hikes lagged Federal Reserve actions. At present the Bank of Israel Benchmark Rate (the nearest equivalent to the Fed Funds rate in America) is 4.5%.

Perhaps surprisingly, rising interest rates have proven far more impactful to Israeli financial markets than the street protests and political turmoil emanating from the current Israeli government’s judicial reform proposals. Nonetheless, as we noted in our letter several weeks ago, the outcome of this debate remains highly consequential for Israel’s long-term prosperity. Although judicial reform bluster and vitriol was temporarily interrupted by Israel’s five-day conflict with Palestinian Islamic Jihad in the Gaza Strip, we expect the debate and negotiations to resume in the coming days.

Israeli Stock Valuations are Attractive

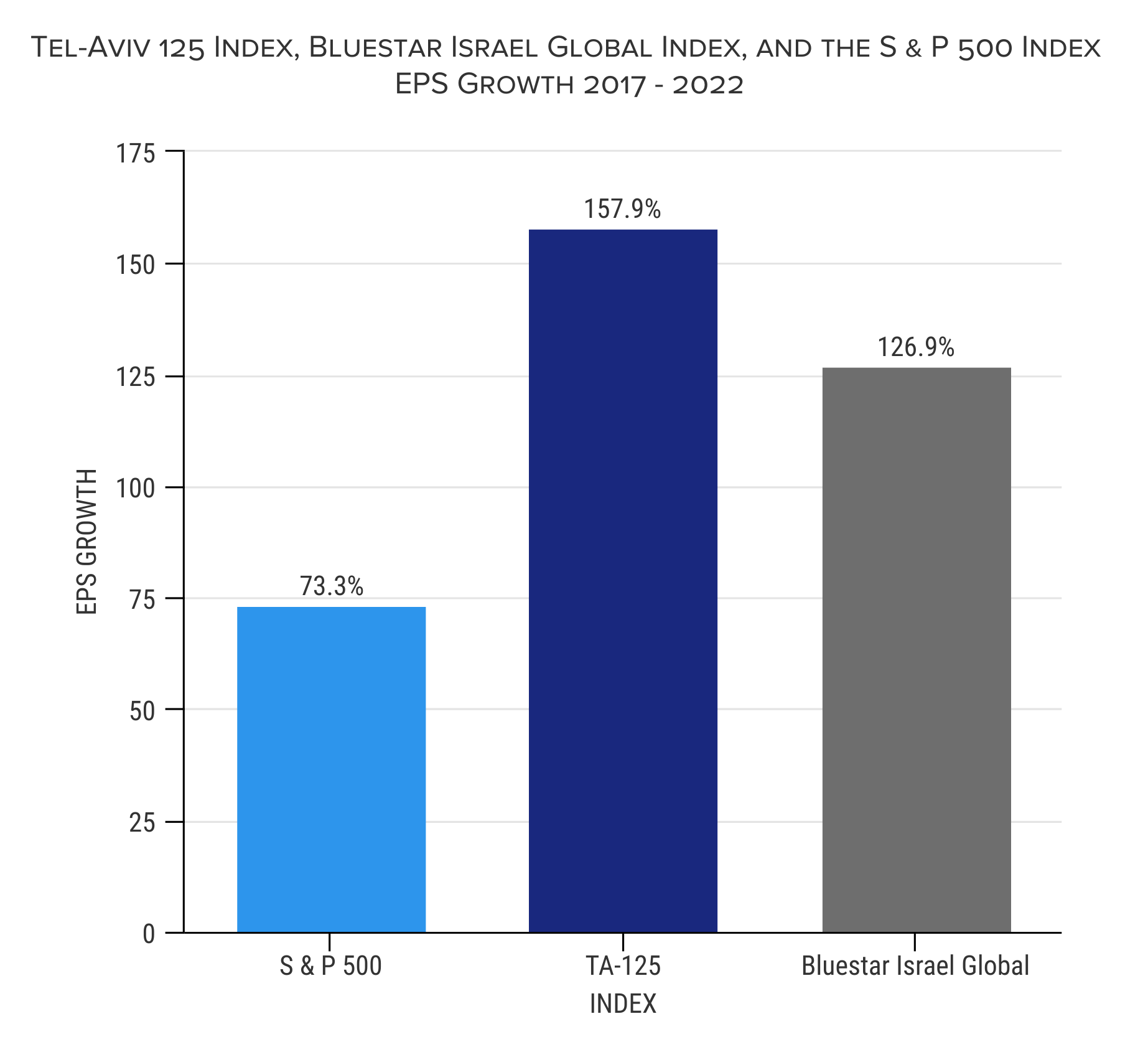

Israeli company valuations are quite low at the present time. We cannot predict how and when recovery will occur, but we believe the current economic and political turmoil presents significant investment opportunity for investors with a long-term horizon. Over the past five years the Earnings per Share (EPS) for both the Tel-Aviv 125 Index and the Bluestar Israel Global Index more than doubled. Given the negative sentiment of the moment, the Price-to-Earnings Ratio (P/E) for the TA-125 Index fell from 16.4 at the end of 2021 to 8.5 now and from 17.8 to 9.9 on the technology heavy Bluestar Israel Global Index. The Israeli Indexes now trade at a substantial discount to American stocks represented by the S & P 500 Index despite their faster earnings growth. (Charts 1 & 2, Source: Bloomberg, L.P.).

Chart 1

Chart 2

As a reminder, the P/E ratio is an indicator of potential investment yield. If a company earns $1 per year and can be purchased for $9.90 today, then $1/$9.90 = 10.1%. Similar arithmetic for the Tel-Aviv 125 Index in December 2021 when the P/E was 16.4 indicates $1/$16.40 = 6.1%. Earnings growth can add to these expected yields if realized over time.

Higher interest rates and a weaker global economy could impact Israeli companies in the near-term. Israeli and foreign capital will likely remain on the sidelines until the government satisfactorily resolves the judicial controversy, but we remain optimistic now that all sides are engaged in substantive negotiations. Israeli stocks are inexpensive despite Israel’s prospects for strong economic and earnings growth in the coming years. At Israel Investment Advisors, LLC we believe Israel’s current rough patch is an investment opportunity for patient investors with perseverance.